As the e-commerce landscape continues to evolve, financial management for online businesses becomes increasingly crucial. Shopify, a leading e-commerce platform, offers a range of tools to help merchants streamline their operations, and one of these tools is Shopify Balance.

What is Shopify Balance?

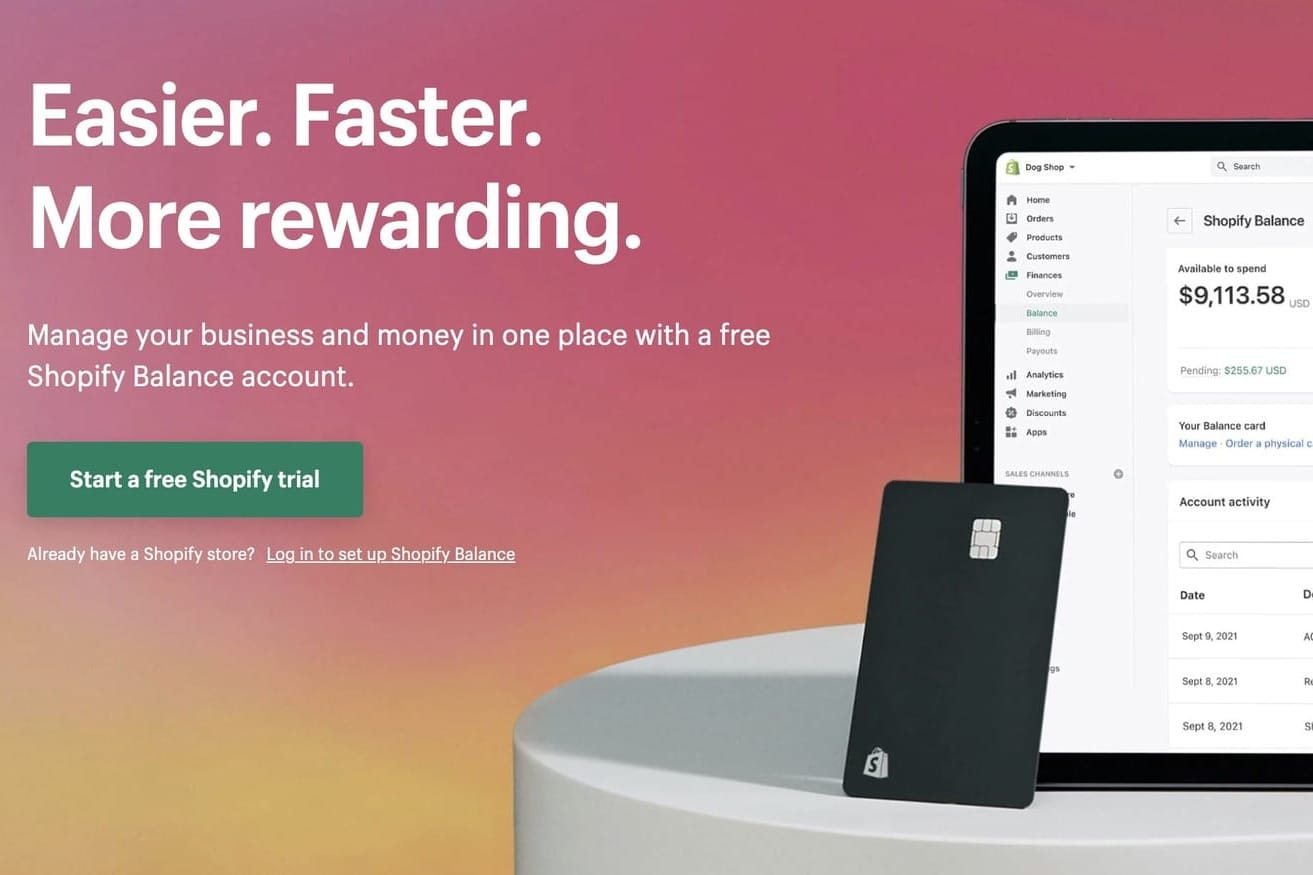

Shopify Balance is a financial service designed specifically for Shopify merchants to manage their business finances more effectively. It combines banking features with the convenience of being integrated directly into the Shopify platform. Shopify Balance includes a business account, a debit card, and a suite of financial tools that help merchants track their cash flow, manage expenses, and reinvest in their businesses.

Key Features of Shopify Balance

1. Business Banking Account

Shopify Balance provides merchants with a business banking account that allows them to manage their funds directly from their Shopify admin. This account is tailored to meet the needs of e-commerce businesses and is fully integrated with the Shopify platform.

- No Monthly Fees: Unlike traditional banks, Shopify Balance does not charge monthly maintenance fees, making it cost-effective for small and medium-sized businesses.

- No Minimum Balance Requirements: Merchants can maintain any balance in their account without worrying about minimum balance fees.

2. Shopify Balance Card

The Shopify Balance Card is a debit card that can be used for business expenses. Merchants can use the card for online purchases, in-store transactions, and ATM withdrawals.

- Instant Access to Funds: Sales revenue is available immediately for use with the Shopify Balance Card, enabling quicker access to funds.

- Cashback Rewards: Merchants earn cashback on eligible purchases made with the Shopify Balance Card, helping them save money on business expenses.

3. Financial Insights and Reporting

Shopify Balance offers comprehensive financial insights and reporting tools to help merchants track their cash flow and understand their financial health.

- Real-Time Analytics: Merchants can view real-time analytics of their income and expenses, helping them make informed financial decisions.

- Expense Categorization: Transactions are automatically categorized, simplifying bookkeeping and financial management.

4. Integration with Shopify Payments

Shopify Balance is seamlessly integrated with Shopify Payments, allowing merchants to manage their payouts and cash flow in one place.

- Automatic Payouts: Funds from sales processed through Shopify Payments are automatically deposited into the Shopify Balance account.

- Unified Dashboard: Merchants can manage their sales, expenses, and payouts from a single dashboard, streamlining financial management.

Benefits of Using Shopify Balance

1. Simplified Financial Management

Shopify Balance simplifies financial management by consolidating banking, payouts, and expenses into one platform. This integration reduces the complexity of managing multiple financial accounts and services.

2. Improved Cash Flow

With instant access to funds from sales, merchants can improve their cash flow and reinvest in their businesses more quickly. The ability to use the Shopify Balance Card for immediate expenses ensures that merchants can manage their operational needs without delays.

3. Cost Savings

Shopify Balance offers a cost-effective banking solution with no monthly fees or minimum balance requirements. Additionally, merchants can earn cashback on purchases, further reducing business expenses.

4. Enhanced Financial Insights

The real-time financial insights provided by Shopify Balance help merchants make informed decisions about their business. Understanding cash flow, expense patterns, and financial health enables better planning and strategy.

How to Get Started with Shopify Balance

Step 1: Sign Up for Shopify Balance

To start using Shopify Balance, merchants need to sign up for the service through their Shopify admin. The signup process is straightforward and involves providing basic business information.

Step 2: Set Up the Shopify Balance Account

Once signed up, merchants can set up their Shopify Balance account. This involves linking the account to their Shopify Payments and configuring any necessary settings.

Step 3: Activate the Shopify Balance Card

Merchants will receive the Shopify Balance Card, which can be activated through the Shopify admin. The card can then be used for business purchases and expenses.

Step 4: Manage Finances through Shopify Admin

With the account and card set up, merchants can manage their finances directly from the Shopify admin. This includes tracking income, managing expenses, and utilizing financial insights to make informed decisions.

Final Thoughts

Shopify Balance is a powerful financial solution designed to meet the unique needs of e-commerce businesses. By integrating banking features, a debit card, and financial insights directly into the Shopify platform, Shopify Balance simplifies financial management, improves cash flow, and helps merchants make informed business decisions. Whether you're a small business owner or managing a larger enterprise, Shopify Balance offers the tools and flexibility needed to streamline your financial operations and drive business growth.